By Susan Thuvi

When we talk about pay, it’s easy to slip into the language of percentages, benchmarks, and market rates. But behind every paycheck is something much bigger; it decides whether people can afford safe housing, care for loved ones, or simply have peace of mind.

That came through clearly in a recent employee survey we conducted, which offered a closer look at how pay is shaping daily life in today’s economy. The findings were a reminder that compensation isn’t just a business decision but a social one, with real consequences for wellbeing, performance, and the future of work.

Living on the edge

One of the clearest themes to emerge was financial fragility. Many employees are living paycheck to paycheck, with little or no savings. For some, borrowing has become a monthly routine just to get by. Others are making tough trade-offs – skipping meals, walking long distances to save on transport, or settling for unsafe housing.

These aren’t abstract statistics. They’re lived experiences that directly affect health, safety, and quality of life. Employees shared that even small, unexpected costs like a medical bill, a repair, a sudden family need, can throw their entire month into turmoil. This constant financial balancing act creates stress that doesn’t stay at home; it follows people into the workplace, affecting focus and energy levels.

In other words, financial stress is not just a personal problem. It becomes an organizational one too.

The breadwinner burden

Another standout finding was that most employees are the primary breadwinners for their families. That means one salary is often stretched across school fees, healthcare, rent, food, and extended family obligations.

For some, the paycheck is gone within days of hitting the bank account. Rent, utilities, and groceries absorb the lion’s share, leaving little left for savings or personal needs. The weight of responsibility is heavy, not only providing for oneself but ensuring children are educated, relatives are cared for, and households keep running.

This breadwinner role magnifies financial pressure. It also explains why many employees in today’s workforce report fatigue, anxiety, and a diminished sense of work-life balance . The reality is that when work pays only enough to scrape by, employees have little energy or headspace to invest in growth, innovation, or long-term planning.

The cost-of-living squeeze

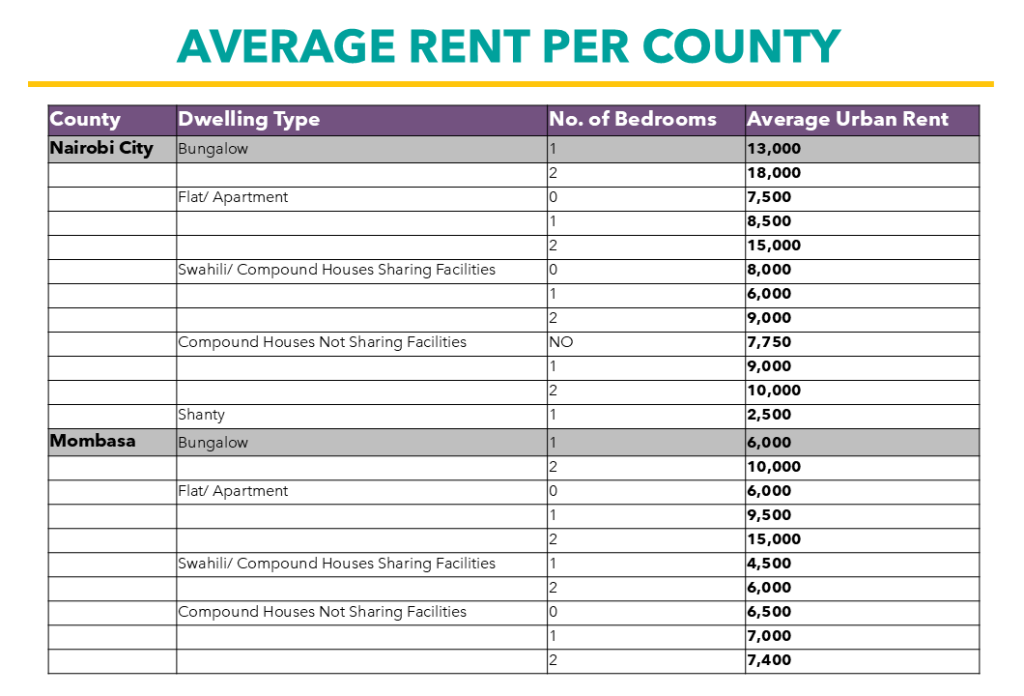

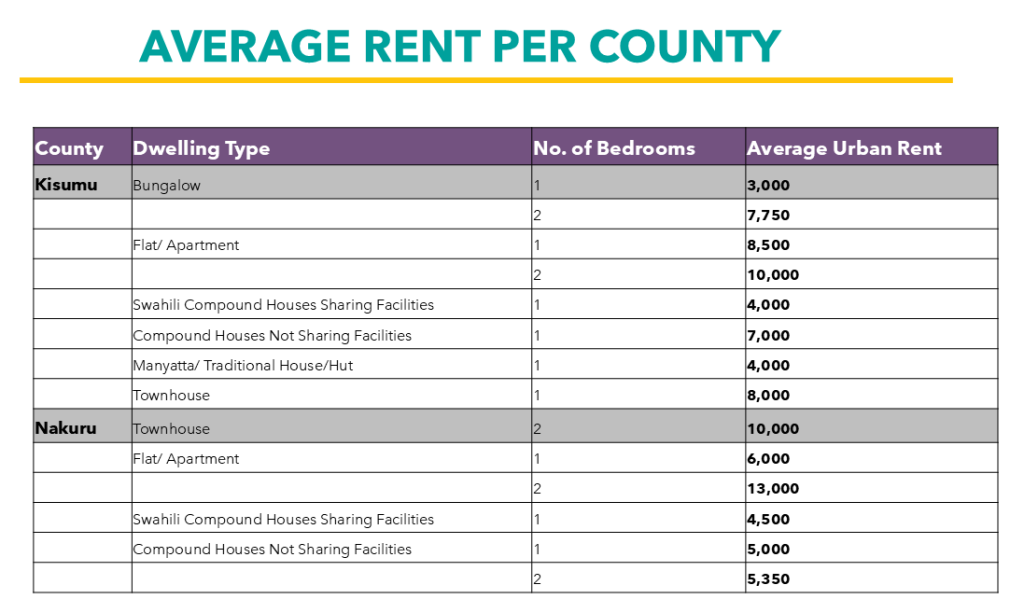

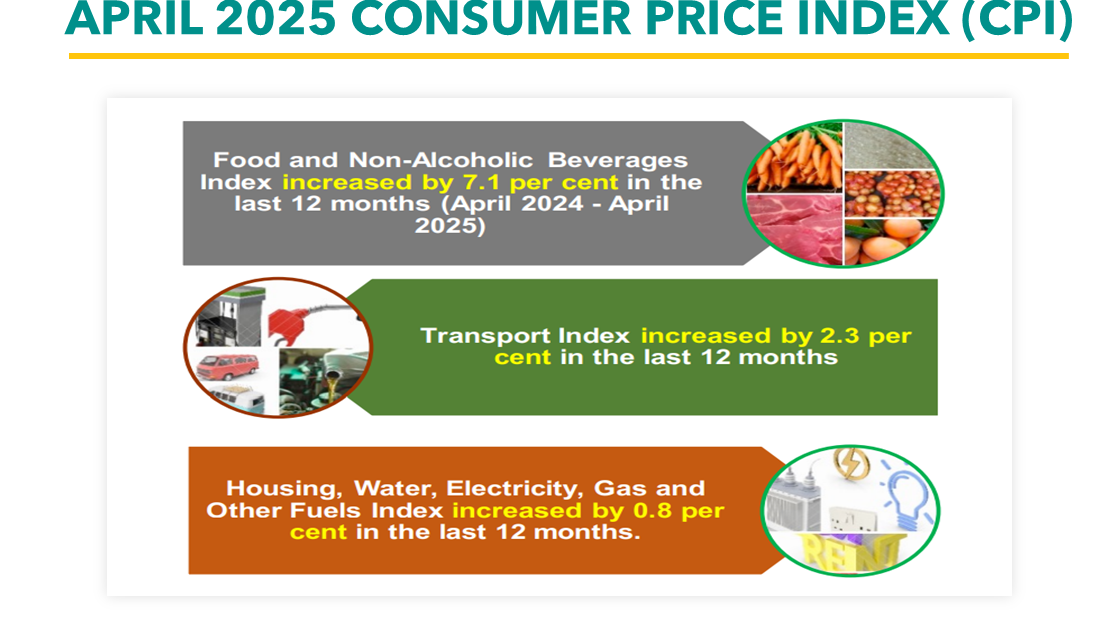

The rising cost of essentials is a recurring theme. Employees pointed to food, transport, and housing as the biggest drains on their income. Rent alone can take up to half of a monthly paycheck. Transport is another significant cost, especially for those commuting long distances every day. Add in inflation-driven food prices, and the math simply doesn’t balance.

Source: https://www.knbs.or.ke/wp-content/uploads/2025/01/2023-24-Kenya-Housing-Survey-Basic-Report1.pdf

Taxes and statutory deductions add yet another layer, reducing take-home pay at the same time that living costs rise. This creates a cycle of instability. Salaries remain static while expenses rise, leaving them feeling like they are working harder but falling further behind.

What’s striking is that these pressures don’t just affect low-income employees. Even those earning above-average salaries report that the rising cost of living makes saving or building wealth nearly impossible. It highlights how compensation structures need to evolve to match real-world conditions, not just market benchmarks.

Source: https://www.knbs.or.ke/wp-content/uploads/2025/05/2025-Economic-Survey.pdf

What fair pay means to employees

Fair pay, in their eyes, isn’t about luxury. It’s about dignity, stability, and the chance to plan a future rather than constantly putting out fires in the present. When asked what they would do if pay and benefits improved, the responses were largely practical:

- Secure decent, safe housing.

- Access reliable healthcare without fear of debt.

- Save for emergencies, retirement, and children’s education.

- Reduce reliance on loans and short-term borrowing.

- Reclaim work-life balance and invest in personal development.

The general sentiment can be summed as: “If I could just meet my family’s needs without borrowing, I’d finally have the energy to focus on growth at work and in my life.” That emphasises that pay is not just transactional – it fuels motivation.

Why it matters for employers

From an organisational perspective, fair pay should be looked at as an investment that unlocks potential. At the most basic level, the return on investment to employers when employees are compensated fairly include:

- Skills development: Competitive salaries attract and support skilled individuals who are more likely to invest in continuous learning and improvement

- Enhanced productivity: When salaries go up, people are likely to feel more motivated and get more done.

- Increased security: Providing adequate pay helps meet basic financial needs, lowering the temptation for unethical actions such as theft or misuse of company resources

Companies that under pay face the hidden costs of financial stress: absenteeism, burnout, high turnover, and low morale. Compensating for these shortcomings is expensive often costing more than investing upfront in fair wages and benefits. Organisations that treat pay as an investment, not just an expense, build more resilient teams.

The bigger picture

At its core, the conversation about pay is a conversation about people; their wellbeing, their hopes, and their ability to thrive in a changing economy. It’s tempting to think of salaries as static numbers, neat and predictable. But every paycheck is tied to a story of resilience and sacrifice. Behind the figure on the payslip is a person working hard, often carrying the weight of entire households.

To reduce compensation to a cost line is to miss its true significance. Pay shapes how families live, how communities function, and how organisations succeed. Aligning pay with the true cost of living is not just an act of goodwill. It’s a smart strategy that strengthens both people and performance.